The benefits for the reader of studying diverse companies are many. To learn

how a novel business model might challenge our existing way of thinking about our business?

What would we need to do differently to implement this business model?

Which other companies excel at what we are trying to do, and what can we learn from them?

What are the key value drivers of this particular business model? and

Could this business model lead to scalability?

A Glut of Used Hogs Is a Drag on Harley-Davidson

For some younger riders, new motorcycles are too expensive, while well-maintained used ones offer good value

Three used Harleys are sold in the U.S. for every new one. A decade ago, it was the other way around. New motorcycle sales in the U.S. are down by half from a 2006 peak, while used sales are up 13%.

Milwaukee-based Harley in 2018 is heading for its fourth straight year of declining sales as the company’s core older customers scale back purchases while younger riders fail to pick up the slack. A glut of used Harley-Davidsons has emerged after years of strong sales growth and production volumes, and offers a variety of choices for those unwilling to splurge on pricey new models.

“It comes down to price, always,”said Jim McMahan, co-owner of a Harley dealership in Greensburg, Pa. “There are people who just don’t want to spend $18,000 to $25,000 on a new motorcycle.”Used Harleys in good condition can cost less than $15,000, dealers say.

Harley wants to reverse its sales slump by drawing new riders with 16 middleweight bikes it plans to roll out by 2022. Among them will be the company’s first electric model, which will make its debut next year.

Harley hasn’t released prices for the new bikes, but dealers expect many of the models will be cheaper than the big bikes that make up the core of the current lineup. Offering more motorcycle choices at lower prices could lure younger riders to the Harley brand for the first time and help offset slumping sales of traditional models.

Heather Malenshek, Harley’s vice president of marketing, said used Hogs—as the brand’s motorcycles are affectionately known—aren’t the company’s biggest problem. “The greatest challenge is to bring younger people into the sport,”she said. “Our used-motorcycle base is a great way to get them in.

But some Harley fans—including one Harley salesman—say the price of a new Harley deterred them from buying one. John Call, 31 years old, has sold Harleys at a dealership outside of Cleveland since 2016. In buying his first Hog last year, he chose a used 2009 Dyna Fat Bob for just under $10,000. “A new Harley isn’t really practical for me,” he said “I’ve got a growing family.”

Harley-Davidson motorcycles tend to have long lives. They don’t wear out easily or go out of style quickly and owners tend to take care of them, making the bikes appealing in the used-motorcycle market.

Harley has struggled to lessen its reliance on baby boomers, whose growing discretionary income and passion for hobbies including motorcycle riding brought the company back from the brink of bankruptcy in the early 1980s. Now, those riders are aging and buying motorcycles less frequently. But younger riders often can’t afford as many bikes as their parents or don’t see themselves living the Harley free-spirit lifestyle.

In response, the company is pursuing younger people who don’t fit the profile of a typical Harley fan: male and clad in a black T-shirt and leather vest. On Monday, Harley said it would start selling its popular branded apparel through Amazon.com Inc. Currently, Harley apparel is sold through the company’s website or at dealerships.

Some dealers said the move could diminish foot traffic to their businesses. “We generate a lot of revenue from our general merchandise,”said Scott Maddux, a Harley dealer near Knoxville, Tenn. “It’s an important part of our business.”

Two of Harley’s new models will be dual-purpose bikes for riding on both paved and unpaved roads, a motorcycle category that is growing in popularity in the U.S. Nine will be sports bikes with racing-style body features and seating to reduce wind drag. Harley doesn’t currently compete in either of these categories.

Some dealers said they doubt customers for those kinds of bikes will one day trade up for a new, expensive Hog. Ms. Malenshek acknowledged some might not, but said Harley also needs to accommodate riders who aren’t interested in its traditional models.

“The point of all of this is bringing new customers into the brand that weren’t there before,”she said. “They don’t all want to be in the lifestyle. You can have Harley on your terms.”

The new models are also designed to attract riders overseas, where Harley wants to generate half its sales a decade from now, up from about 39% currently. Harley in June said it would shift production of motorcycles bound for Europe out of the U.S., after the European Union imposed what would have amounted to a roughly $2,200 tariff on each Hog imported from the U.S.

President Trump and unions representing Harley workers said Harley was using the trade fight to justify existing plans to move production overseas. Harley said that assertion was false.

Many foreign markets are dominated by Harley’s competitors. Japan’s Kawasaki Heavy Industries , Suzuki Motor Co. and Honda Motor Co. make popular utilitarian bikes, while Germany’s BMW AG and Italy’s Ducati, owned by Volkswagen AG , make higher-priced models.

Harley faces those same competitors in the U.S., too, along with a resurgent U.S.-based competitor in Indian Motorcycles, owned by Polaris Industries Inc.

Harley still accounts for about half of sales of U.S. motorcycles built for riding on highways. That share has held steady in recent years even as its own sales stalled because the market for new motorcycles overall has shrunk since the 2008-2009 recession.

And some riders of used Harleys do eventually buy a new one. Sarah Pellatiro of New Kensington, Pa., bought a new Harley Sportster this year for just under $12,000 after riding a used version for three years. Ms. Pellatiro said she chose the middleweight bike over a larger, more expensive model because she was confident she could handle it in traffic after gaining experience with a used Sportster.

“I got that bike right when I was still learning how to ride,”said the 32-year-old photographer and silversmith. “I don’t think I’ll ever ride any brand other than Harley from here on."

EXPERIENCE PATAGONIA

‘I'm Sorry, Yvon's Out Surfing’

For the past 45 years, Patagonia has been a business at the cutting edge of environmental activism, sustainable supply chains, and advocacy for public lands and the outdoors. Its mission has long been “Build the best product, cause no unnecessary harm, use business to inspire and implement solutions to the environmental crisis.”

For 33 years Patagonia has had an on-site child care center that bears little resemblance to what anyone might imagine corporate on-site child care looks like. It is run by teachers, some of whom are bilingual and trained in child development. Learning takes place outdoors as much as in. Parents often eat lunch with their kids, take them to the farmer’s market or pick vegetables with them in the “secret”garden. When Yvon Chouinard, Patagonia’s iconic founder, and his wife Malinda started the company, their employees were friends and family and they wanted to support them as they worked, and started their families.

“It lets you be the kind of parent you want to be.”The solution was not to fix a problem, but to respond to what humans need, including a place to nurse newborns, and later, to provide safe and stimulating child care.

The results three decades later are not surprising: 100% of the women who have had children at Patagonia over the past five years have returned to work, significantly higher than the 79% average in the US. About 50% of managers are women, and 50% of the company’s senior leaders are women.

Patagonia’s $20 Million & Change fund was launched in 2013 to help innovative, like-minded startups bring about solutions to the environmental crisis and other positive change through business. Or, in Yvon’s words, to help entrepreneurs and innovators succeed in “working with nature rather than using it up.” Today, we’re introducing you to one of those companies, Bureo, a B Corporation and member of 1% for the Planet.

THE KROCHET KIDS

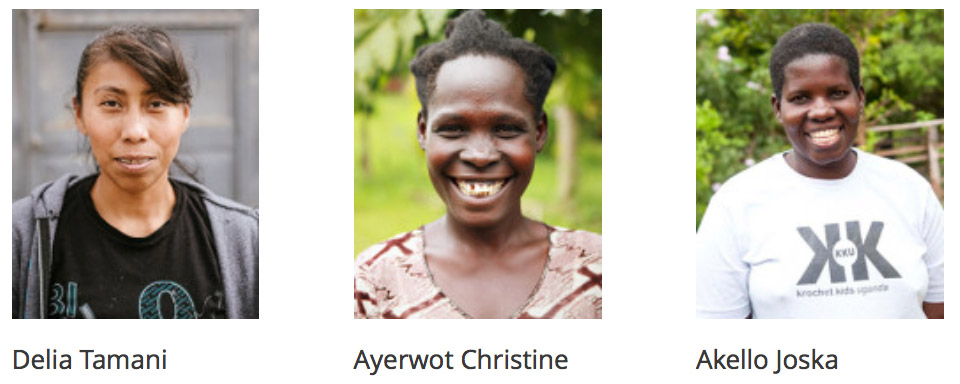

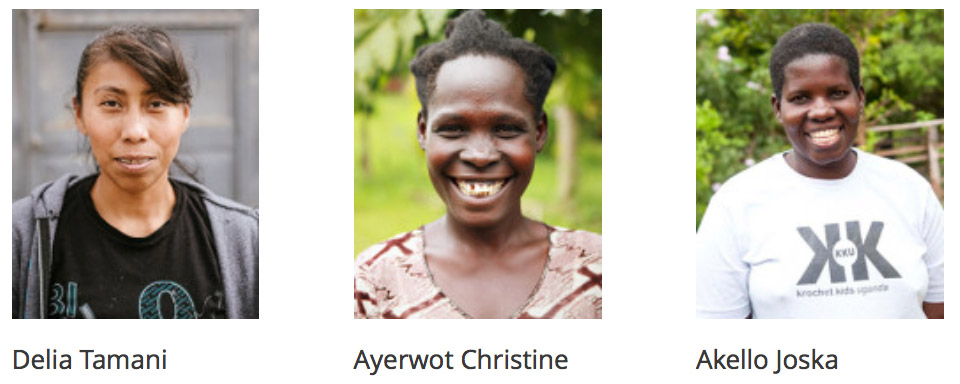

Today, over 150 people in Uganda and Peru are working, receiving education, and being mentored toward a brighter future in creating gifts that give back. The products created abroad have been well received here at home and the collaboration of our staff and beneficiaries around the globe has created a sustainable cycle of employment and empowerment. Krochet Kids is know for their products that include a tag attached with the signature of the person who made it.

Meet the ladies that made your product.

The Krochet Kids quickly grew beyond us...

College found us three friends at different schools. Although there were brief resurgences of the crochet craze amongst new friends, we ultimately began exploring new opportunities — surfing, traveling. During our summer breaks we volunteered in various developing nations, hoping to gain a better understanding of the global community in which we lived. It wasn’t long before we came to realize how blessed we had been growing up. The desire was planted within us to help. To reach out in love. To make a difference. This is their story.

Through a unique model Krochet Kids are empowering the women of Northern Uganda and Peru with the assets, skills, and knowledge to lift themselves and their families out of poverty. The result is long lasting and sustainable change.

We provide a job so that women can meet the present needs of their families. We educate them so that they develop beyond the need for outside aid. We provide mentorship to help each lady plan a unique and sustainable career path for the future.

Learn more about Krochet Kids

WARBY PARKER

Almost one billion people worldwide lack access to glasses, which means that 15% of the world’s population cannot effectively learn or work. To help address this problem, Warby Parker partners with non-profits like VisionSpring to ensure that for every pair of glasses sold, a pair is distributed to someone in need. How did they grow so quickly? Read this to find out. How Did Warby Parker Grow to a $1.2 Billion Ecommerce Company in 5 Years?

-

Warby Parker ground rules:

- Treat customers the way we’d like to be treated.

- Create an environment where employees can think big, have fun, and do good.

- Get out there.

- Green is good.

How they grew the business.

At both Harry's and Warby Parker, our teams sweat every little detail. Our product design and the look and feel of both brands communicate quality, establish our perspective on the world, and reinforce our purpose in the eyes of our customers. We never cut corners. Everything we create should be exactly the way we want it, from the physical design to the words published on our website – we want to make sure that the brand experience is consistently simple and delightful. We believe you only have one chance to make a first impression on someone, so we sweat the details to make that first impression as good as it can be. Jeffrey Raider, Co-Founder of Warby Parker and Harry's in a Pulse interview.

Their message. Our customers, employees, community and environment are our stakeholders. We consider them in every decision that we make. Learn more at Warby Parker

Why This Shaving Startup Made a $100 Million Gamble on a 100-Year-Old Factory

Harry's story is similar to Warby Parker's. Harry's is a disruptive company started by Warby Parker co-founder, Andy Katz-Mayfield. What makes Harry's story unique is their purchase of the production of razor blades. Harry's wanted to seize a different angle--creating a better-designed razor and shaving experience for a reasonable price. Read more here: Why This Shaving Startup Made a $100 Million Gamble..

Get fit in style with new Fitbit Blaze™ – the smartest, most motivating, most stylish fitness tracker yet. This versatile timepiece fits seamlessly into your life with a sleek design, an enhanced fitness experience with advanced coaching, easily interchangeable accessories, and the smart features you need to stay connected.

Fitbit was founded in early 2007 by James Park and Eric Friedman, who saw the potential for using sensors in small, wearable devices. They raised $400,000 but soon realized that that wasn't enough, so they did the rounds of potential investors with little more than a circuit board in a wooden box.

But the idea was good, and when Fitbit addressed the TechCrunch 50 conference in 2008, Park and Friedman hoped to get 50 pre-orders, although Eric suspected the actual number would be nearer five. In fact, in one day, they took 2,000 pre-orders.

Getting orders orders turned out to be the easy part. Neither Park nor Friedman had any manufacturing experience. As Park recalled in an interview with Jeff Clavier at the Computer History Museum:

“Several times, we were pretty close to being dead. We probably spent about three months in Asia looking at suppliers, bringing up production lines.”

There were also problems with their design, the antenna wasn't working properly. “In my hotel room I was thinking this is it,” Park said. “We're done. We literally took a piece of foam and put it on the circuit board to fix an antenna problem.”

Fitbit launched its tracker at the end of 2009, shipping around 5,000 units with a further 20,000 orders on the books.

Because Fitbit was selling its product directly to customers, those 5,000 units were sold with "pretty darn good" profit margins - but Park and Friedman knew that to ship big numbers, they'd need big partners. They raised more money from venture capitalist Brad Field, teamed up with Best Buy to reach four, then 40, then 650 Best Buy stores. Fitbits are now sold in thousands of retail outlets worldwide.

One of the reasons for Fitbit's ongoing success is its investment in new models.

The first tracker was pretty good, but in 2011 Fitbit improved it by adding an altimeter, a digital clock and a stopwatch. That was the Ultra.

From the very beginning, one of Fitbit's strengths was its website: you'd upload information from your Fitbit device to the web so you could analyze your performance and share it with other Fitbit users.

In 2011, however, that caused a little bit of a problem: it turned out that users who recorded their sexual activity (in terms of time spent, not what they spent the time doing) were unwittingly sharing that information with the world, and with Google.

Fitbit realized that "share all my stuff with everyone" wasn't the best default option, and it changed its site so that user information would be private by default.

One of the problems of being an innovator is that you can end up at the forefront of issues you might not have considered, and in the case of Fitbit one of those issues is privacy. Health data recorded by Fitbit isn't legally protected in the way normal medical records are, and that means Fitbit's data can be subpoenaed by the relevant authorities. reference: wareable

Fitbit announced on 2/21/2014 that it would recall its new Force model, after users complained of rashes and burns while wearing it. Fitbit CEO James Park says the recall was motivated by “an abundance of caution.”

Fitbit Inc. is an American company headquartered in San Francisco, California. Founded and managed by James Park and Eric Friedman, the company is known for its products of the same name, which are activity trackers, wireless-enabled wearable technology devices that measure data such as the number of steps walked, heart rate, quality of sleep, steps climbed, and other personal metrics. The first of these was the Fitbit Tracker.

On May 7, 2015, Fitbit announced it had filed for an initial public offering (IPO) with a NYSE listing. The IPO was filed for $358 million. The company's stock began trading with the symbol “FIT” on June 18, 2015.

CEO James Park is a serial entrepreneur with a passion for creating great products and companies. Fitbit is the third startup that he has founded. Previously, James was a Director of Product Development at CNET Networks, where he led product management, engineering, and design for Webshots.

Before CNET, James was a co-founder of Windup Labs, which was acquired by CNET in 2005, and prior to Windup Labs, he was the co-founder and CTO of Epesi Technologies.

James also worked at Morgan Stanley, where he helped develop trading strategies and software for a quantitative trading fund.

James never quite finished his computer science degree at Harvard College. reference:

Fortune

“While Fitbit is clearly the overall leader compared to the other fitness bands such as Jawbone, Garmin and Misfit, a lead that is continuing to grow even over the last month, in the overall wearables category where smartwatches come into play, fitness bands in general are dropping as a share of the market,” said John Feland, CEO and founder, Argus Insights.

Fitbit is losing out as a part of this comprehensive wearables category with a mindshare ranking of far less than the 68-percent market share disclosed in the S-1. Says Feland, “Fitbit will need to differentiate itself more as almost any smartwatch and other wearable product out there will tell you how many steps you took and lets you share that information with your friends.”

“Fitness bands stop being useful and people lose their fitness momentum – all similar reasons as to why people quit going to the gym," Feland said. “For Fitbit to continuously grow, they will need to keep users engaged and give them reasons to buy new versions of the products. Right now our data indicate that other more comprehensive devices are taking over for fitness trackers.”

Argus Insights also expects the number of “white label” fitness bands to increase in six months – just as white label tablets proliferated. “ Learn more on white-labeling. It won’t matter that the generic fitness band does not have the brand identity. It will definitely be cheaper and work almost exactly the same way.” For example visit this Alibaba site for fitness-trackers.

When a company "white-labels," it simply means that another company will be rebranding one of its products or services to make it appear as the purchasing company's own.

“To sum up,” says Feland, “we think Quarter 2, 2016 is looking weak for Fitbit compared to the other brands globally. They are especially impacted by slack demand for their smartwatch which was introduced in December. We recommend a wait and see attitude when it comes to Fitbit and their future.”

The Fitbit Surge, Fitbit’s smartwatch, had a rocky launch over the holidays when users’ reactions were extremely negative, and Fitbit is only now recovering. Improved strength with Fitbit’s watch is very important if the company wants to compete with the Apple Watch and myriad other smartwatches now on the market.

One other area where competitive pressures may come to bear, according to Feland, is in the growth of cheaper, while still adequate, white label fitness bands enabled by motion sensor suppliers like Invensense and its Sharkband fitness band reference platform.

For more information about the Argus Insights Fitbit Demand Report, visit Argus Fitbit Insights

“We operate in a highly competitive market. If we do not compete effectively, our prospects, operating results, and financial condition could be adversely affected. The connected health and fitness devices market is highly competitive, with companies offering a variety of competitive products and services. We expect competition in our market to intensify in the future as new and existing competitors introduce new or enhanced products and services that are potentially more competitive than our products and services. The connected health and fitness devices market has a multitude of participants, including specialized consumer electronics companies, such as Garmin, Jawbone, and Misfit, and traditional health and fitness companies, such as adidas and Under Armour.

In addition, many large, broad-based consumer electronics companies either compete in our market or adjacent markets or have announced plans to do so, including Apple, Google, LG, Microsoft, and Samsung. For example, Apple has recently introduced the Apple Watch smartwatch, with broad-based functionalities, including some health and fitness tracking capabilities. We also compete with a wide range of stand-alone health and fitness-related mobile apps that can be purchased or downloaded through mobile app stores. We believe many of our competitors and potential competitors have significant competitive advantages, including longer operating histories, ability to leverage their sales efforts and marketing expenditures across a broader portfolio of products and services, larger and broader customer bases, more established relationships with a larger number of suppliers, contract manufacturers, and channel partners, greater brand recognition, ability to leverage app stores which they may operate, and greater financial, research and development, marketing, distribution, and other resources than we do.

Our competitors and potential competitors may also be able to develop products or services that are equal or superior to ours, achieve greater market acceptance of their products and services, and increase sales by utilizing different distribution channels than we do. Some of our competitors may aggressively discount their products and services in order to gain market share, which could result in pricing pressures, reduced profit margins, lost market share, or a failure to grow market share for us. If we are not able to compete effectively against our current or potential competitors, our prospects, operating results, and financial condition could be adversely affected.” From public documents submitted to the SEC and accessed on the Edgar data base.

Fitbit relied on its popular Fitbit Charge and Fitbit Surge models to maintain its leadership in the worldwide wearables market, and also saw continued growth within the Asia/Pacific and Europe, Middle East, and Africa (EMEA) markets. Equally noteworthy has been its fast-growing Corporate Wellness strategy during the quarter, which added North American retailer Target and its order of 335,000 fitness trackers for its employees. Target joins Bank of America, Time Warner, and more than 70 other Fortune 500 companies to deploy Fitbit devices to its employees.

The big picture for Fitbit, Woody Scal Fitbit’s chief business officer said, is its evolution into a digital monitoring platform to discover and prevent health problems. Fitbit has teamed up with corporations that offer wellness programs for employees. BP, for example, offers Fitbits to more than 23,000 employees, partly to ensure they are getting enough sleep before they work on oil rigs. Mr. Scal said the data from sleep monitoring, a feature built in to all Fitbit devices, could lead to new health revelations.

Fitbit’s mission is to help people lead healthier, more active lives by empowering them with data, inspiration, and guidance to reach their goals. They design their products primarily in California and outsource the production of their devices to contract manufacturers, which are responsible for procuring most of the components used in the manufacturing of our products from third-party suppliers. They also outsource packaging and fulfillment to third-party logistics providers around the world.

Fitbit generates substantially all of it’s revenue from sales of their connected health and fitness devices. They sell their products in over 50,000 retail stores and in 63 countries, through their retailers' websites, through their online store at Fitbit.com, and as part of their corporate wellness offering. They seek to build global brand awareness, increase product adoption, and drive sales through their sales and marketing efforts. They intend to continue to significantly invest in these sales and marketing efforts in the future.

Fitbit has spent heavily to drive its sales growth and future product launches. Operating costs nearly tripled in 2016, causing profit to plunge 77% to 5 cents a share after the payout of preferred dividends. As a result, shares dropped about 12% in after-hours trading.

“Our hope is to accelerate the pace of development that we have on the product side, and also lower the time frame in which we launch products,” said Fitbit Chief Executive James Park.

Fitbit Sales Climb, but Expenses Eat Into Profit - WSJ May 4,2016

Full-year and second-quarter 2016 guidance continues to reflect the company’s planned higher investments in research and development to accelerate the pace of innovation to deepen its competitive moat; investments in sales and marketing to drive revenue from new products in 2016; and investments in consumer engagement features to accelerate the network effect of the company’s large user community, to strengthen consumers’ brand preference.

On May 19, 2016 it was reported that Coin, a startup was going out of business.

Fitbit is moving to add a mobile payments feature to its market-leading line of activity trackers, but slowly.

The company purchased wearable payments technology from startup Coin last week, but won’t integrate the feature into new bands until at least next year, CEO James Park told Fortune. The deal also includes intellectual property and key engineering and sales personnel from Coin, but doesn’t involve the company’s mobile wallet. reference; Fortune

tech–crunch reported on 12/1/2016 “ It looks consolidation is acoming to the wearables space with Fitbit set to acquire smartwatch maker and multi-million-dollar Kickstarter-darling Pebble, according to a report from The Information. Pebble released the newest version of its smartwatch in October, but the past year or so has been a challenging period.

Fitbit, too, has experienced its own challenges. The company priced its shares at $50 when it listed on the New York Stock Exchange in 2015, but today it is trading at $8.40. That depression is largely due to less-than-impressive financial results. Some may cite the emergence of Apple and the Apple Watch as a competitor, but analyst reports have noted that smartwatch sales are tanking as initial consumer interest in wearable devices has waned.“ The problem might be that once you have one you don't need another. And, everyone who wanted one has one! Added 12/1/2016

Fitbit's Financial Results 2015 and 1st Quarter 2016

Income Statements/ Statements of operations show the companies performance over a period of time.

View here: Fitbit's three months results for the first quarter 2016

Balance Sheets are a company's snapshot at a moment in time. View Fitbit's Balance Sheet for 2015 here: FIT Balance sheet 2015

From Bloomberg

“Fitbit Inc. will eliminate about 110 jobs, or 6 percent of its workforce, and said fourth-quarter results won’t meet analysts’ estimates amid declining demand for its fitness trackers. Fitbit expects to report that it sold 6.5 million devices in the quarter ended Dec. 31 2016, with revenue of $572 million to $580 million, the company said in a statement Monday. Analysts were expecting $736.4 million, on average. Fitbit forecasts revenue in 2017 of $1.5 billion to $1.7 billion. Analysts had estimated $2.38 billion. Official results are due to be released Feb. 22.”

“That is a brutal miss, following on last quarter's brutal miss. As I noted then, Fitbit is in a pretty untenable position: Apple will take the high end wearable market, while Chinese competitors will take the low-end. The company's fundamental flaw has always been that wearables as accessories leaves no room for a non-Apple branded offering, but neither Fitbit nor the state of technology was in a state to create wearables that were standalone devices, at least not yet. That was compounded by the upgrade problem: if you already have a Fitbit, why would you buy another one? Clearly most people didn't.” reference - stratechery, 2/1/2017.

keurig coffee

Keurig /ˈkjʊərɪɡ/, is a beverage brewing system for home and commercial use. It is manufactured by the American company Keurig Green Mountain, which is headquartered in Waterbury, Vermont. The main Keurig products are: K-Cup pods, which are single-serve coffee containers; other beverage pods; and the proprietary machines that brew the beverages in these pods.

“From Keurig’s founding in 1992 until their departure in 1997, Sylvan and Dragone hacked together prototype after prototype, working in small offices in Waltham and doing most of the taste-testing themselves. For the first few years, they drew no salary and were turned down for funding by scores of venture capitalists.” retrieved from: Boston Globe - The Buzz Machine Author, Daniel McGinn (August 7, 2011)

It launched its first brewers and K-Cup pods in 1998, targeting the office market. As the single-cup brewing system gained popularity, brewers for home use were added in 2004. In 2006 the publicly traded Vermont-based specialty-coffee company Green Mountain Coffee Roasters acquired Keurig, sparking rapid growth for both companies. In 2012 Keurig's main patent on its K-Cup pods expired, leading to new product launches, including brewer models that only accept pods from Keurig brands. Keurig has also entered the cold-beverage market with Brew Over Ice, and with Keurig Kold, which launched in September 2015; and it entered the soup market with a line of Campbell's Soup K-Cups which also launched in September 2015.

From 2006 to 2014 Keurig, Inc. was a wholly owned subsidiary of Green Mountain Coffee Roasters. When Green Mountain Coffee Roasters changed its name to Keurig Green Mountain in March 2014, Keurig ceased to be a separate business unit and subsidiary, and instead became Keurig Green Mountain's main brand. In December 2015 it was announced that Keurig Green Mountain would be sold to an investor group led by private-equity firm JAB Holding Company for nearly $14 billion; the acquisition was completed in March 2016.

Keurig founders John Sylvan and Peter Dragone had been college roommates at Colby College in Maine in the late 1970s. In the early 1990s Sylvan, a tinkerer, had quit his tech job in Massachusetts, and wanted to solve the commonplace problem of office coffee – a full pot of brewed coffee which sits and grows bitter, dense, and stale – by creating a single-serving pod of coffee grounds and a machine that would brew it. Living in Greater Boston, he went through extensive trial and error trying to create a pod and a brewing machine. By 1992, to help create a business plan, he brought in Dragone, then working as director of finance for Chiquita, as a partner. They founded the company in 1992, calling it Keurig; Sylvan later said that the name came from his having "looked up the word excellence in Dutch”.

By 1993 Sylvan and Dragone were still making the pods by hand, and brought in manufacturing consultant Dick Sweeney to serve as co-founder and to automate the manufacturing process. The prototype brewing machines were also a work in progress and unreliable, and the company needed funds for development. That year, they approached what was then Green Mountain Coffee Roasters, and the specialty coffee company first invested in Keurig at that time. Keurig needed sizeable venture capital; and after pitching to numerous potential investors the three partners finally obtained $50,000 from Minneapolis-based investor Food Fund in 1994, and later the Cambridge-based fund MDT Advisers contributed $1,000,000. In 1995 Larry Kernan, a principal at MDT Advisers, became Chairman of Keurig, a position he retained through 2002. Sylvan did not work well with the new investors, and in 1997 he was forced out, selling his stake in the company for $50,000. Dragone left a few months later but decided to retain his stake. Sweeney stayed on as the company’s vice president of engineering.

In 1997, Green Mountain Coffee Roasters became the first roaster to offer its coffee in the Keurig "K-Cup" pod for the newly market-ready Keurig Single-Cup Brewing System, and in 1998 Keurig delivered its first brewing system, the B2000, designed for offices. Distribution began in New York and New England. The target market at that time was still office use, and Keurig hoped to capture some of Starbucks' market. To satisfy brand loyalty and individual tastes, Keurig found and enlisted a variety of regionally known coffee brands that catered to various flavor preferences. The first of these was Green Mountain Coffee Roasters.

Keurig also partnered with a variety of established national U.S. coffee brands for K-Cup varieties, and in 2000 the company also branched out the beverage offerings in its K-Cup pods to include hot chocolate and a variety of teas. The brewing machines were large, and hooked up to an office's water supply; Keurig sold them to local coffee distributors, who installed them in offices for little or no money, relying on the K-Cups for profits.

In 2002, Keurig sold 10,000 commercial brewers. Consumer demand for a home-use brewer version increased, but manufacturing a model small enough to fit on a kitchen counter, and making them inexpensively enough to be affordable to consumers, took time. Office models were profitable because the profits came from the high-margin K-Cups, and one office might go through up to hundreds of those a day.

By 2004, Keurig had a prototype ready for home use, but so did large corporate competitors like Salton, Sara Lee, and Procter & Gamble, which introduced their own single-serve brewers and pods. Keurig capitalized on the increased awareness of the concept, and sent representatives into stores to do live demonstrations of its B100 home brewer and give out free samples. Keurig and K-Cups quickly became the dominant brand of home brewers and single-serve pods.

Product - Keurig K-Cup brewing systems

The company's flagship products, Keurig K-Cup brewing systems, are designed to brew a single cup of coffee, tea, hot chocolate, or other hot beverage. The grounds are in a single-serve coffee container, called a "K-Cup" pod, consisting of a plastic cup, aluminum lid, and filter. Each K-Cup pod is filled with coffee grounds, tea leaves, cocoa powder, fruit powder, or other contents, and is nitrogen flushed, sealed for freshness, and impermeable to oxygen, light, and moisture.

The machines brew the K-Cup beverage by piercing the foil seal with a spray nozzle, while piercing the bottom of the plastic pod with a discharge nozzle. Grounds contained inside the K-Cup pod are in a paper filter. Hot water is forced under pressure through the K-Cup pod, passing through the grounds and through the filter. A brewing temperature of 192 °F (89 °C) is the default setting, with some models permitting users to adjust the temperature downward by five degrees.

Information on Keurig retrieved from: Wikipedia 6/7/2016

“Keurig Green Mountain Inc. is pulling the plug on its countertop soda machine after launching it amid great fanfare last year but failing to win over consumers.”

“On Tuesday, the maker of coffee machines and K-cups said it is discontinuing Kold, its pod-based appliance that allowed users to make chilled Coca-Cola, Dr Pepper and other carbonated beverages at home.

Keurig had high hopes of making Kold a kitchen fixture—much like its popular coffee makers that took American households by storm the last decade. Coca-Cola Co. Chief Executive Muhtar Kent called Kold “a real game-changing’’ innovation in early 2014, when the soda giant took a minority stake in Keurig and agreed to make its brands available.

Instead, Waterbury, Vt.-based Keurig sold only a few thousand machines after launching Kold in the U.S. last September. A store rollout faltered and in April the company said the machines would only be sold online.

Many consumers balked at the price of the machine, which initially cost $369. The pods also were pricey, costing $1.25 to make an 8-ounce drink. And the machine took up a lot of counter space and about 60 seconds to make a single serving—much longer than it takes to grab a ready-made bottle or can of Coke from the fridge.”

“Underscoring Kold’s struggles, Keurig recently offered the machines for as little as $199 and slashed the price of pods to 50 cents, to no avail.

“While it delivered a great-tasting cold beverage, the initial execution didn’t fully deliver on consumer expectations, especially around size, speed and value,’’ said Suzanne DuLong, a Keurig spokeswoman.”

“ ‘People today, even though they talk about make my own, if it takes 45 seconds to make a Pepsi at home as opposed to three seconds to pop open a can, they think that’s 42 seconds wasted,’ PepsiCo Chief Executive Indra Nooyi told a soda-industry conference in late 2014.”

from reference: WSJ Keurig-discontinues-cold-drink-carbonation-machine-after-sales-fizzle Author, Daniel McGinn August 7, 2011

One of the issues face by Keurig is recycling the pods. Keurig Green Mountain is secretive about how many K-Cups the company actually puts into the world every year. The best estimates say the Keurig pods buried in 2014 would actually circle the Earth not 10.5 times, but more than 12. reference: The Atlantic

Video retrieved from Protein Journal article

A new coffee pod brand launched in the U.K., with, at the heart of its strategy, a direct “ J’accuse” of existing producers in the market, in particular, the Europe-dominant Nespresso. Halo, a super-premium coffee in a totally biodegradable pod, has drawn considerable interest in the days following its debut. Nils Leonard says, “ First of all, if there were just a premium pod, a pod that has exquisite coffee, because the coffee as it stands in the majority of pods is very average. Deeply middle of the road. But then you start looking at the problems in the category and we thought if we did that in a way that wasn’t shit for the world then that would be great.” retreved from Fastcocreate.com

Blue Apron

Image from the Blue Apron website.

Image from the Blue Apron website.

Meal kits may make cooking easier, but getting a box of pre-portioned ingredients and instructions to a customer’s door is one of the most complicated logistics riddles in the food business.

Blue Apron's food system–the way in which food is grown and distributed–is complicated, and

making good choices for your family can be difficult. Blue Apron is changing that: by partnering with farmers to raise the highest-quality ingredients, by creating a distribution system that delivers ingredients at a better value and by investing in the things that matter most—our environment and our communities. They predict that it will be a decades–long effort, but with each Blue Apron home chef, together with us they can build a better food system. To learn how Blue Apron built their business and how they intend to grow the business and create the new food system visit this article by Jing Cao published by Bloomberg.

To explain their complicated food system Blue Apron has created a wonderful graphic that scrolls a naritive on their website home page to make the process easy to understand. Check it out here: Blue Apron

The company filed for an initial public offering in the U.S. Thursday, after reportedly delaying listing preparations while it worked to improve financials. While revenue more than doubled last year, Blue Apron is still losing money as it fights to win customers from competitors such as HelloFresh AG and Sun Basket Inc. as well as publicly listed giants like Amazon.com Inc. Indeed the threat from Amazon materialized quickly when Amazon agreed June 16, 2017 to buy Whole Foods.

Gaining share in the busy U.S. food-delivery market is expensive: Blue Apron spent $144 million on marketing last year, or about 17 percent of its total operational spending. The company has been working to reduce the cost of acquiring customers, aligning that outlay more closely with the value of long-term subscribers, a person familiar with the matter said last year. retrieved from: Bloomberg

One of the clouds hanging over Blue Apron since its IPO has been the looming threat of what an Amazon-Whole Foods combination could mean for its business. But when Blue Apron’s stock got hammered on 8/10/2017, falling more than 17 percent by day’s end, that had nothing to do with it; it was the company’s disappointing financial forecast for the back half of the year that was the culprit. The company is in the midst of a vicious cycle that goes something like this: Blue Apron is experiencing warehouse issues that are causing customer satisfaction issues that are causing retention issues that are causing marketing issues that are causing revenue issues. The company is in the midst of a vicious cycle that goes something like this: Blue Apron is experiencing warehouse issues that are causing customer satisfaction issues that are causing retention issues that are causing marketing issues that are causing revenue issues.

Blue Apron’s market share declined 17 percentage points in September 2017 from 57.5 percent a year earlier, while most other meal kit services gained market share in the $5 billion U.S. meal kit market. Their market share as of September 2017 was 40.3%. Blue Apron doesn’t retain customers as well as some of their smaller competitors, leading people to spend less with the companies over time. A year after the Blue Apron’s customer’s first purchase, they held on to 15 percent of its customers. Blue Apron reported an annual decline in average revenue per customer in its 2017 second-quarter filings. The company reported that in order to offset new plant startup expenses they would reduce marketing spending.

The WSJ reported on 2/13/2018: Blue Apron Holdings is hemorrhaging customers, as operational problems and rising competition jeopardize its rank as the largest meal-kit company in the U.S. The New York City company on Tuesday reported 746,000 customers for 2017’s final quarter, down 15% from a year earlier and 13% from three months prior. At its peak early last year, Blue Apron had more than a million customers buying its subscription meals of pre-portioned ingredients. Executives said they would start advertising again this year to attract customers and aim for the company to break even next year.

“There is ... cost associated with that training of people who are not doing day-to-day proactive work while they're being trained,”he added, “as well as impact from people who are doing work who are just early in their life cycle of being trained.” The result has been mistakes that are hurting Blue Apron’s OTIF rates — that is, the percentage of orders that arrive on time and with all the correct ingredients (in full), the company said. retrieved from recode article “Perishable food isn’t a widget, right?”

dated 8/11/2017.

The lifetime value (LTV) of a customer is pretty straightforward to understand: how much revenue will you earn from a customer for the duration of the time they are a customer, minus how much it will cost to serve them, discounted by the cost of capital. Why discount? Because there’s one more piece of the LTV equation: how much it costs to acquire that customer, and that cost is borne today, while revenue isn’t realized until the future (and future revenue is worth less than cash paid for customer acquisition today). See discounted cash flow article on Wikipedia.

While the company is benefiting from scale (the company’s gross margins are decreasing as the customer base grows), there are no network effects or other means by which Blue Apron is becoming more valuable to marginal customers. That means that, outside of cutting prices, the only way to grow is to spend more money on customer acquisition, and that is a very good way to make the lifetime value of a customer negative. Ben Thompson Blue Apron sought to sell shares between $15 and $17 apiece, which would have valued the company at $3 billion at the midpoint of the range. However, the startup struggled to find buyers at those prices. Investors who considered the IPO expressed concern about Blue Apron’s marketing costs and customer turnover, according to fund managers and analysts.

In the brutal business of food delivery Blue Apron isn't the only company to struggle. Recode commenting on the closing of Maple, “These companies save money compared to traditional restaurants by not having to pay for brick-and-mortar storefronts. But it is expensive to retain and attract customers as a digital business, and the economics of on-demand delivery continue to be difficult to overcome. It doesn’t help that these companies have relatively low average order values for an e-commerce business”.

“In 2015, Maple, a New York City startup that had essentially built a delivery-only restaurant inside of an app, was losing money on an average order, leaked documents showed. By March of 2016, gross margins were still just 2 percent. Part of the company’s original pitch was that customers would pay a fixed price for a lunch or dinner meal that included all fees and tips. But last year, the company added a $1.95 delivery fee, a sure sign that the original model was not sustainable.” retrieved from recode

The onsen

Image from the Offscreen website.

Image from the Offscreen website.

A number of years ago I discovered food pouches at Starbuck. Their unique packaging that provided nutritional snacks led me to Shazi Visram and the Happy Family company. In 2011, founder and CEO Shazi Visram earned the title of Ernst & Young's Entrepreneur of the Year for New York. While studing for her MBA at Columbia University she put together the basics of a business plan and began networking in the food industry. That business plan included an exit plan. An exit plan as part of a business plan stuck in my mind and when I saw an article titled An Exist Strategy published in the Off Screen blog I was drawn to it.

An onsen is a Japanese hot spring and the bathing facilities and inns frequently situated around them. The onsen in this story has been in existence since 705 AD. “The staff are hardworking, courteous, and committed to exemplary service. They embody omotenashi: the spirit of selfless service and humble hospitality. With an understanding that each of those they serve has different needs, there is a desire to put their patrons first, personalise their experience, and exceed expectations. The staff are dedicated not to reaching the top of the corporate ladder, but instead to protecting the onsen, to help it thrive and preserve it for years to come. The meals served aim to ‘balance taste, texture, appearance, and the season’. Fresh, seasonal ingredients are used, foraged and caught in the nearby mountains and rivers.”

The onsen has stayed small. They know what they do, and they do what they know. Their focus on service is relentless. They are a team united in its mission to protect, to nurture, to tend to, to keep alive – a delicate balance of continuation, innovation, and dedication that has endured for hundreds and hundreds of years.

A hat tip to Natasha Lampard for this wonderful story An Exist Strategy